Gone are the days when financial education stopped at handing over a weekly allowance and hoping for the best. In today’s world of online banking, instant spending, and digital wallets, raising financially fit kids means going way beyond “save your change” and “don’t spend it all in one place.”

Parents: The goal is no longer just teaching your child to save—it’s teaching them how to earn, manage, and grow money. Financial fitness is like physical fitness: it takes consistent habits, real-world practice, and an understanding of how all the parts work together.

Students: The earlier you start learning how money flows, the more freedom and control you’ll have in the years ahead. Being financially fit means knowing how to make smart choices with the money you have—and how to build toward the life you want.

Here’s how to level up beyond allowance:

1. Replace Allowance with Earning Opportunities

Instead of giving a fixed weekly amount, tie money to tasks or goals. This could be household responsibilities, tutoring, pet-sitting, or part-time jobs. It teaches that money is earned—not guaranteed.

2. Break Down the Flow of Money

Teach kids how to divide their earnings:

- Save at least 10%

- Spend wisely

- Invest when possible

- Donate to causes they care about

This not only builds strong money habits, it builds character and purpose.

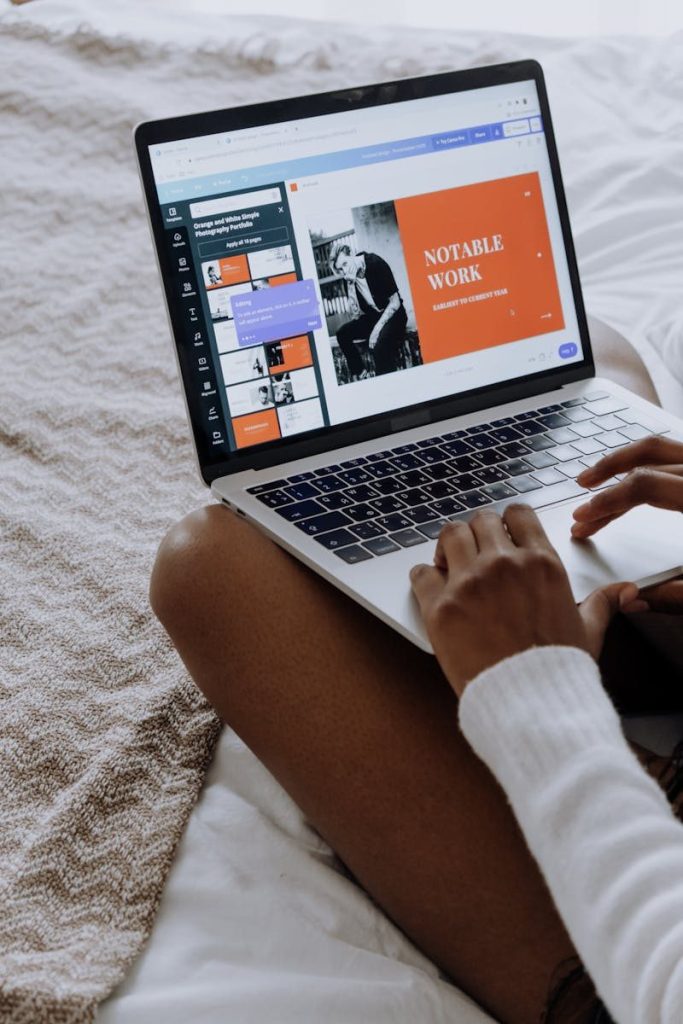

3. Use Tools That Make It Real

Introduce budgeting apps like Greenlight, GoHenry, or simple spreadsheets. Show them how to track their spending weekly. Make it visual and engaging—not overwhelming.

4. Shift the Conversation from Spending to Planning

Talk about money the way you talk about school or sports—something to improve at over time. Ask questions like:

- “What are you saving for?”

- “How can you earn more this summer?”

- “What would you do differently with your spending next month?”

5. Be Transparent

Parents, share your own experiences—the wins and the mistakes. Talk about budgeting for family vacations or how you paid off a credit card. Real-life context helps lessons stick.

Raising a financially fit young adult isn’t about controlling their every purchase. It’s about giving them the skills, tools, and confidence to make wise choices. Allowance may be a start—but independence is the real goal.

Because what good is a degree… if you can’t manage your money?